Building valuable, long-term customer relationships requires reacting swiftly with relevant content while accounting for your customers’ individual needs and preferences. Customers increasingly expect one-to-one communication, requiring you to know what they did in the past, what they are currently doing, and what they will most likely want or do in the future. At the same time, companies need to account for new channels, technologies, and data sources. It is challenging for marketers to keep pace with the rapidly changing ecosystem.

Customer Data Platforms (CDPs) are designed to help marketers meet these challenges: CDPs are marketer-managed systems that provide unified and persistent customer profiles which are used for segmentation and marketing automation across channels. CDPs are versatile in handling vast amounts of complex data in real time and pursue a holistic approach by orchestrating all channels and integrating whatever tools and systems you need.

Integrating the most suitable – and often best-in-class – point solutions with a CDP is often referred to as integrated best-of-breed approach. A study by Walker Sands and Chiefmartec.com from 2017 suggests that integrated best-of-breed technology stacks will be the future of marketing and CRM. According to the study, “integrated best-of-breed marketers get the most value from their technology stacks”. Single-vendor suites like marketing cloud solutions perform significantly worse, and they can’t keep pace with the rapidly changing ecosystem. Their generalized approach makes them sluggish in adopting new trends, channels, and technologies. Given these circumstances, it is not surprising that CDPs are gaining momentum in Europe.

CDPs Are on the Rise in Europe

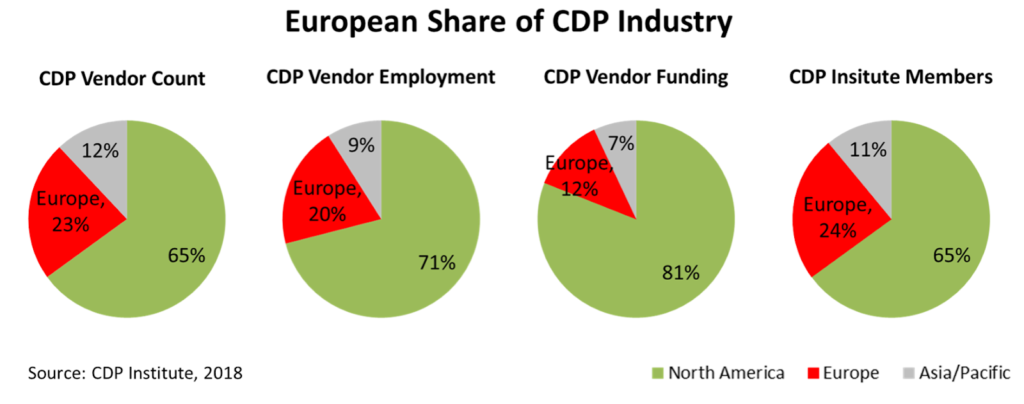

According to the CDP Institute’s latest industry update from January 2018, the industry has doubled since 2017 with a total funding of $1.2 billion. The fastest growth can be seen outside the U.S. The report reveals considerable CDP activity in Europe. Nearly one-quarter of the CDP vendors represented in the report are based in Europe. Several European vendors have added headquarters in the U.S. while vice versa, some U.S.-based CDPs show significant European business.

Is Europe Lagging Behind?

It has been a question of faith whether the U.S. market is ahead of the European market regarding marketing technology in general and customer data management in particular. Nevertheless, a lot of European vendors in these areas have relocated to the U.S. The overall larger market size in the U.S. has undoubtedly also contributed to this migration.

According to a study from Econsultancy, at least the assumption that Europe is lagging behind in integrating their marketing technology stacks is a myth: 9% of European countries reported a highly integrated tech stack, barely under the 10% figure for North American companies. The figures for companies with a “somewhat integrated” stack are similar for the U.S. and Europe with 29% in both markets.

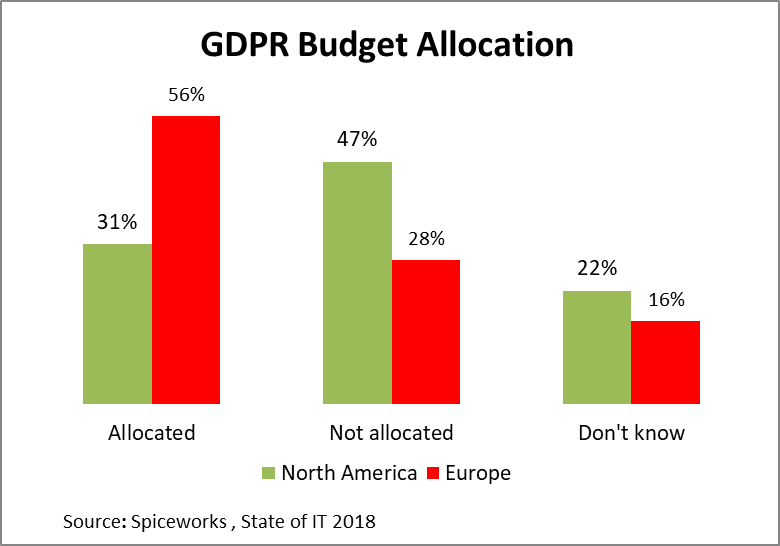

Europe Is Ahead in Preparation for GDPR

The General Data Protection Regulation (GDPR) is coming. Since it’s a European regulation and fines up to €20 million or 4% of the annual global turnover can be levied, it is no surprise that Europeans are ahead in preparation for GDPR. A recent survey by Spiceworks found that 56% of European companies had allocated funds for compliance compared with just 31% of U.S. companies. Though GDPR applies globally, almost half the U.S. respondents believe GDPR wouldn’t affect them. But if U.S. vendors want to gain a foothold in the European market, they need to be GDPR-compliant. Europe’s head start in preparation for GDPR can mean a significant advantage as soon as the regulation kicks in. This is especially relevant for CDP vendors since their platforms process customer data in huge numbers.

CDP Institute Europe

Given the global trend as well as the recent developments in Europe, it is standing to reason that the U.S.-based Customer Data Platform Institute expands its activities by launching a European subsidiary later this month together with CrossEngage as a founding partner. The Institute, originally founded by marketing technology consultant and analyst David M. Raab, is a vendor-neutral organization providing information about issues, methods, and technology related to customer data management in general and customer data platforms in particular.